The Middle East’s cryptocurrency mining landscape is poised at a pivotal crossroads as 2025 approaches, heralding not only new VAT regulations but also unlocking vast opportunities for mining machine hosting businesses. As the region increasingly embraces blockchain technology, the intricacies of tax policies intersect with the booming demand for mining rigs and hosting services, reshaping how miners, operators, and investors strategize their ventures.

The imminent VAT changes in several Middle Eastern countries present both challenges and openings. For enterprises engaged in selling and hosting mining machines, understanding these regulations is essential to optimize profitability and compliance. VAT, a consumption tax applied at various stages of goods’ and services’ distribution, can impact the overall cost structure of mining rigs—whether they’re state-of-the-art bitcoin miners or efficient Ethereum mining setups.

As we delve deeper into this evolving fiscal framework, it is vital to appreciate how such taxation alters operational cost dynamics. Hosting providers who manage vast mining farms must recalibrate their pricing models, factoring in VAT implications not only on hardware sales but also on service agreements, electricity consumption, and maintenance charges. An adept grasp of regulatory nuances enables these entities to continue offering competitive lease terms for mining rig accommodations while maintaining robust margins.

Navigating new VAT rules requires mining machine vendors to reassess their supply chains meticulously. For instance, when importing specialized ASIC miners or GPUs designed for Ethereum mining, import VAT could add significant upfront expenditure. However, savvy businesses often leverage exemptions or zero-rating policies applicable to technology or renewable-energy-aligned sectors, thereby mitigating costs and encouraging expansion of mining machine inventories.

Moreover, the rise of hosting solutions allowing clients to deploy their miners in optimized environments is especially pertinent as energy considerations grow more prominent. Many Middle Eastern locales offer favorable climates and energy rates for blockchain mining, attracting a surge of miners looking to host rigs that operate continuously with maximum efficiency and minimum overhead. Hosting companies often bundle VAT-inclusive fees with power costs and security services, offering turnkey solutions that ease operational burdens for individual miners.

A nuanced understanding of VAT’s application also empowers innovative business models blending sales and hosting into cohesive packages. For example, miners purchasing rigs may simultaneously sign hosting contracts that encompass installation, cooling, and remote management, crafting mutually beneficial revenue streams resilient against tax shifts. Particularly, with Bitcoin’s sustained dominance, hosting providers tailor offerings to miners seeking optimized hash rates without the hassle of onsite management, effectively democratizing access to expansive mining farms.

These regulatory evolutions dovetail with the larger narrative of the Middle East positioning itself as a crypto-mining hub. Governments recognize the value in attracting investment by fostering mining-friendly frameworks, encompassing tax incentives, reliable infrastructure, and legal clarity. By aligning VAT impositions with these strategic goals, authorities strike a balance—ensuring fair taxation while not stifling innovation in blockchain’s rapidly evolving ecosystem.

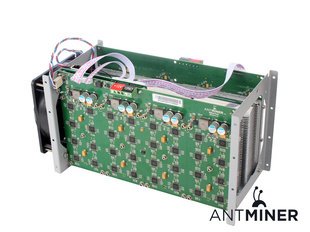

Cryptocurrency mining’s multifaceted nature signals rich domain overlap: Bitcoin’s proof-of-work competitiveness, Ethereum’s ongoing adaptations, and emerging altcoins each generate demand for specialized miners. Thus, selling mining machines spans countless product variants—ASIC machines optimized for BTC, versatile GPU rigs for Ethereum-based tokens, or increasingly hybrid solutions designed to maximize returns across multiple cryptocurrencies. Hosting enterprises tailor environments to accommodate these diverse machines, accounting for cooling requirements, power draw, and network connectivity.

Ultimately, businesses astutely navigating the 2025 VAT landscape strengthen their foothold in the Middle East’s mining machine and hosting markets. Transparency in taxation, coupled with adaptive sales and hosting strategies, empowers stakeholders—from miners seeking economic hosting farms to vendors expanding their rig inventories—to thrive amid change. This fusion of regulatory foresight and operational agility marks the next chapter for the region’s vibrant cryptocurrency mining community.

Written by Grant

1 thought on “Middle East Mining Machine Hosting 2025: Navigating New VAT Rules and Opportunities”

Leave a Reply Cancel reply

归档

- July 2025

- June 2025

- May 2025

- April 2025

- February 2025

- January 2025

- November 2024

- October 2024

- August 2024

- July 2024

- June 2024

- May 2024

- March 2024

- February 2024

- January 2024

- October 2023

- September 2022

- April 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- November 2020

- October 2020

- September 2020

- February 2020

Middle East Mining Machine Hosting 2025 promises to spotlight evolving VAT regulations reshaping industry landscapes, while unveiling innovative mining technologies and untapped market prospects, offering participants a dynamic mix of compliance insights and growth strategies in a rapidly shifting economic environment.